NinjaTrader Programming

As an IT-expert and service-provider with several years of experience with trading software we provide individual sofftware solutions for analytical work and full- and semi-automatic trading strategies. These solutions will be available to you around-the-clock to test and implement your strategies.

NinjaTrader, MultiCharts and MetaTrader are the three most widely used programs for processing market data. We develop custom-made software-solutions for these programs to implement your strageies in the most optimal way.

Ichimoku-Cloud

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on the chart. It also uses these figures to compute a "cloud" which attempts to forecast where the price may find support or resistance in the future.

Download

Filename: Devside_Ichimoku_Cloud.zip

Version: v1.0

Filesize: 2,88 KB

MD5: 4A112DDA54577E261893723DD7D29031

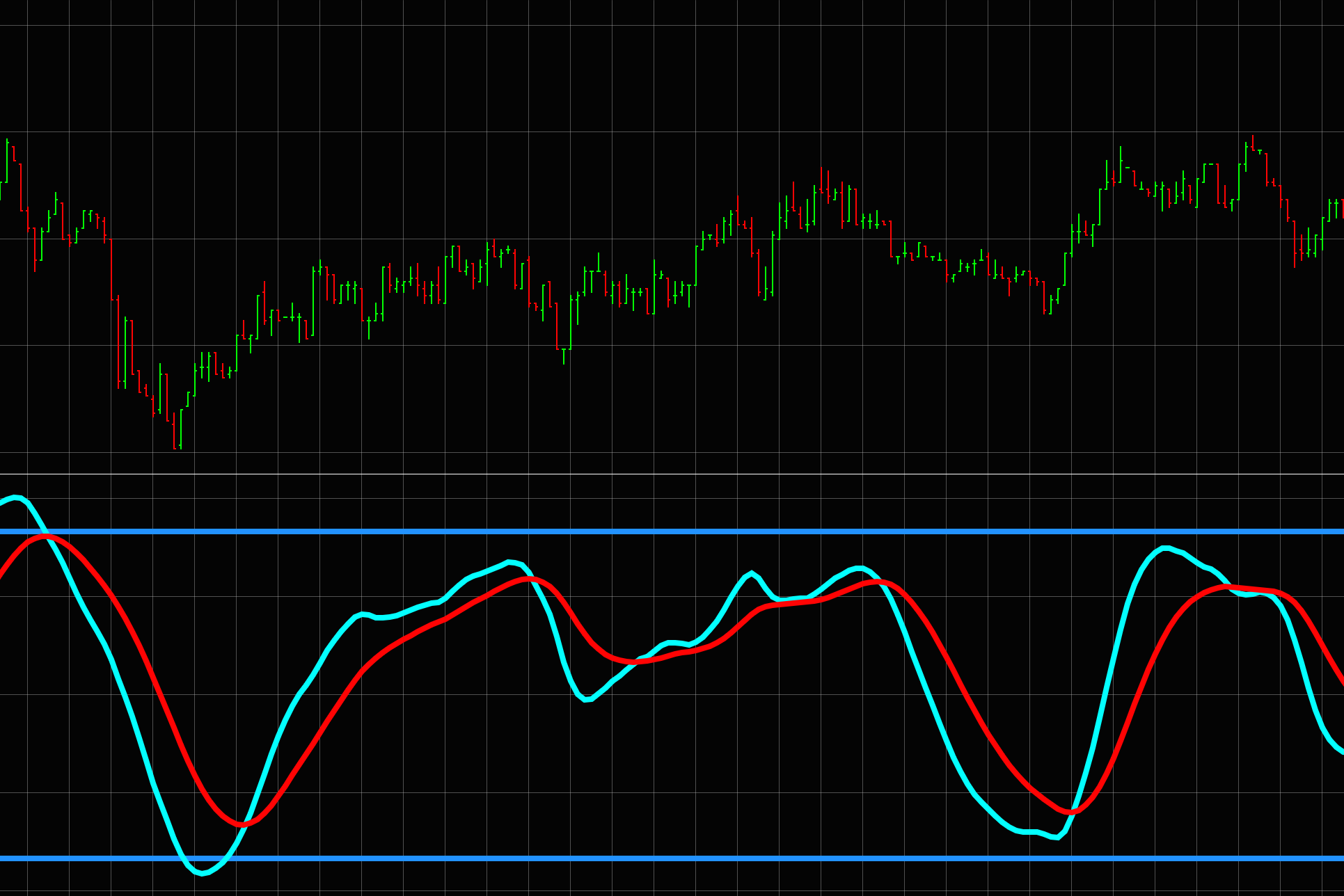

Stochastic Momentum Index (SMI)

The Stochastic Momentum Index (SMI) is a more refined stochastic oscillator. Instead of using the difference between the high/low price and the close price it uses the difference between the midpoint of of the high/low prices and the close price.

The normal value range for the SMI is between +100 and -100. When the close price is higher than the midpoint, the value is positive. When the close price is lower than the midpoint, the SMI has a negative value.

The SMI was designed by William Blau to be a more reliablie Indicator than the stochastic oscillator.

The SMI is often used in with volume indicators or other oscillators.

It also used as a general trend indicator, with values above 40 indicating a bullish trend and values below -40 showing a bearish trend.

Download

Filename:

Devside_Stochastic_Momentum_Index.zip

Version: v1.0

Filesize: 1,93 KB

MD5: 59F728DCBB5318EB37F6E207BFB51706

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.